Vermont is a small, hilly state in the northeast corner of the US, and is often claimed to be the “second cloudiest” state in the nation (a subjective statistic). Although our state has been adopting solar in leaps and bounds, there is a debate over whether solar is an applicable technology in our state and, nationally, if solar should be subsidized now that the production costs have decreased dramatically. I decided to research the history of subsidies and production costs of various fuels to determine if solar deserves to be an incentivized fuel source for electric generation.

Image via Wikipedia.

Image via Wikipedia.

Extracting Subsidies: True Cost of Energy by Fuel Type

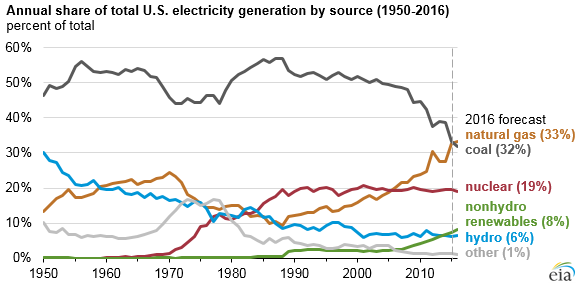

In order to evaluate solar power, I need to compare their costs to all the 2016 U.S. fuel sources of electricity - natural gas (33%), coal (32%), nuclear (19%), non-hydro renewables (8%), hydro (6%) and other (1%).

Source: U.S. Energy Information Administration, Monthly Energy Review, and Short-Term Energy Outlook (March 2016)

Source: U.S. Energy Information Administration, Monthly Energy Review, and Short-Term Energy Outlook (March 2016)

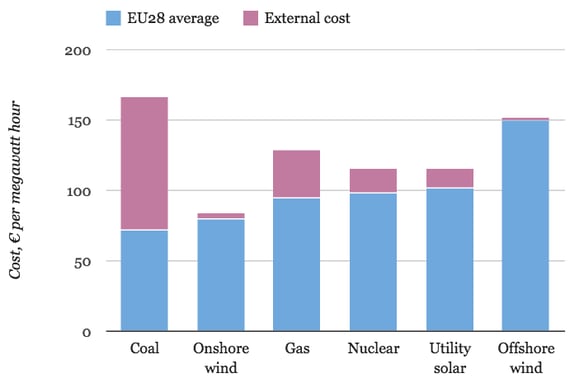

The cost of production (i.e. extracting and burning the coal to produce electricity) is quantifiable, but the societal, environmental, and economic costs known as externalities are more tenuous. It is difficult to quantify the health and safety costs and environmental degradation of coal mines and natural gas fracking or the decommissioning and waste storage costs of nuclear power plants.

I did find the following 2014 graph by Carbon Brief that has quantified this total cost of production (shown in blue) and externalities[1] (shown in pink) of each fuel type in Europe.

Source: Annex 4 of the Ecofys energy costs study - graph by Carbon Brief

Is Solar Cost Effective?

This graph shows that although the sticker price of coal is lower than utility solar, when externalities are taken into account the cost of extracting coal is higher than utility solar. Natural gas, the current favorite fuel source, is almost equal to solar on a first-cost basis and is slightly worse than solar when including externalities.

History and Comparison of Solar Subsidies

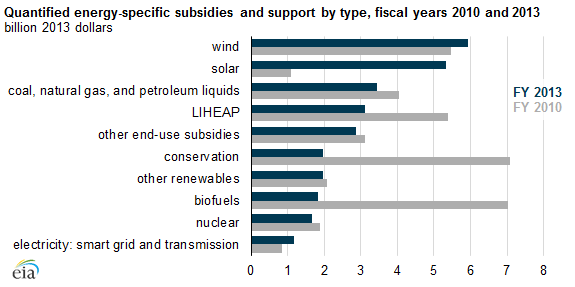

The U.S. has been subsidizing coal, natural gas, and nuclear electric production sources for decades. According to a 2013 study by ReVision Energy, “when the first 15 years of subsidy life are compared, government support for the oil, gas and nuclear industries as a percentage of inflation-adjusted federal spending far outweighed the support granted to renewables.” The latest US Energy Information Administration (EIA) report is from 2015 and compares the energy specific subsidies of 2010 and 2013:

Source: EIA, Direct Federal Financial Interventions and Subsidies in Energy in Fiscal Year 2013. Note: LIHEAP is the Low Income Home Energy Assistance Program.

As the graph shows, subsidies for solar did increase in 2013 to exceed subsidies for fossil fuels. Considering the nation’s carbon-emissions reduction goals, the incomparable profit margins of oil companies, and true cost of fossil fuels, this seems appropriate for 2013. Since then, both solar subsidies and solar array costs have decreased as demand as increased and production is coming of age. Unfortunately, the EIA has not published any more recent statistics, but there are rumblings that the federal tax credits for solar are destined to be reduced in the near future. Vermont is also moving in that direction, with changes to the tax credits and generation incentive (solar adder credit).

Is it Time to End Solar Subsidies?

There are those that are calling for an end to solar subsidies altogether. Vermont State Senator John Rodgers stated, “subsidies on solar should end now that the industry has proven it can make money.” Solar should be treated like any other business, he said, and developers should get the same level of subsidies as his masonry company, which is zero. I see his point if one looks strictly at the business side of the equation. But the goal of solar subsidies is not only to promote the solar-panel manufacturing and installation businesses themselves, but to also promote a more independent and resilient future for our nation at less cost than fossil fuel sources (including externalities). Based on the true cost of all fuel types, solar is a sound financial investment in addition to being an economically responsible solution to the dichotomy between fighting climate change and satisfying our energy needs.

The Personal Impact of Subsidies

In the spirit of full disclosure, I must reveal that I have solar panels on my house and I associate with people who have invested in community solar arrays. My friends and I decided to make the investment last year because we felt the industry has hit a price point that we could financially support, the Vermont tax credit was going away, and the generation incentive was going to be reduced. My tiny 3 kW array produces more electricity than I use in a year (granted, we didn’t have any snow last winter) so my cost for electricity is strictly my investment in my panels. In 10 years I will have paid off the panels and I should have another 15 years of free electricity. I believe the panels will also help me sell my house when the time comes. For all my altruistic reasons for buying solar, however, I must admit the federal and state credits made the investment feasible; without them I would not have chosen to install solar panels. This leads me to the conclusion that subsidies are doing exactly what the federal and state governments intend – increasing the nation’s generating power with a renewable technology whose costs are in line with other fuel sources, while helping meet our carbon-emissions reduction goals.

[1] I have not investigated the assumptions that are included in the externalities of this study.