Last month, at the close of Vermont’s legislative session, the House and Senate agreed to create a Legislative Working Group to investigate reforming VT’s Renewable Energy Standard (RES). This is a big deal because the RES sets the rules by which Vermont utilities claim their electricity is renewable. And now those rules might change.

Passed in 2015, the RES has many critics. Renewable energy developers claim the standard goes too easy on Vermont utilities by letting them import power from large, out-of-state hydro plants to meet renewable percentage targets rather than inducing new renewable builds, as most state standards are intended to do. The RES should be transforming our electric grid, they argue, but instead we’re relying on hydroelectric dams built decades ago, before carbon reduction targets were set.

But if we are lucky enough to reside just south of a huge supply of hydropower, then what’s the problem with using it to meet our renewable energy targets?

Fair Question. I’ll refer you to this 2021 Digger article which unpacks the most common critiques of Vermont’s reliance on Hydro Quebec, but the big ones are: environmental injustices, methane emissions, and the exploitation of legislative differences between states. There’s a lot to unpack, but I want to focus on the last point as an entrée to a larger, more general problem embedded within state legislation not just in VT but around the U.S. Our renewable energy accounting system is flawed in a way that has already stunted the climate response. Unless we make policy changes, we will only fall farther behind.

Friends Don’t Let Friends Buy Unbundled RECs

The problem stems from the fact that we can’t measure electrons directly to tell if they’re renewable or not. Instead, we have to rely on accounting tools like “certificates” and “instruments” to support renewability claims. For example, a solar provider might sell a megawatt-hour for $40, but they can also sell a REC (certificate) for an additional $30 or so. State standards require utilities to obtain and collect RECs and turn them in at the end of the year. In this way, legislation like VT’s Renewable Energy Standard has established a secondary market for certificates on top of the actual, physical market for electricity. You can see how such legislation nominally makes renewable energy projects more valuable by requiring utilities to purchase certificates in addition to purchasing actual power, so renewable builds look more attractive to developers. And indeed, the financial boosts from state-level renewable portfolio standards (RPSs) have contributed to solar and wind taking hold as viable power supply technologies.

Along the way, someone (who must have been a financial strategist and not an engineer!) decided it was a good idea to allow RECs to be “unbundled” from the place and time at which they are generated, meaning they can be purchased independently of the physical renewable energy that gave them life. So for example, the solar provider above could sell their electricity for $40, but then keep the REC because maybe they’ll get a better price later selling just the certificate by itself. The utility then has bought only electricity, so it will have to look elsewhere for a REC to meet the compliance requirements… and maybe the utility will find a cheaper REC somewhere else, later in the year. This capability of RECs to be collected and traded over time contorts renewable energy into something more like a material commodity and less like, say, actual electricity, which currently needs to be ramped up and down to meet grid demand in real time.

Investor-owned utilities use REC arbitrage to find bargains, and who can blame them? With respect to Vermont and large hydro, it’s a pretty sweet deal: Vermont happens to be the only state on our regional grid to allow >100 MW of large, pre-existing hydro purchases to count towards our RPS (most states cap hydro at 30 MW or below, and some have stipulations that only allow much smaller, “run-of-river” hydro). So even though Vermont utilities will spend all year collecting RECs from solar, wind, and other in-state renewables, we eventually unbundle those RECs and sell them to our neighbors, then replace what we sold with a massive import of RECs from Hydro Quebec. These imports are extremely cheap because they’re worth next-to-nothing outside of Vermont. VT utilities praise themselves for profiting from this arbitrage to keep rates low for customers, a sunny interpretation at best. Put another way, Vermont is hampering the growth of renewables in its neighboring states by introducing bulk HQ RECs to the regional marketplace. We are the toxic friend who brings over a six-pack when everyone else is trying to celebrate dry January. It doesn’t count if you didn’t buy it, right?

I hope the legislative working group will take a hard look at the well-established criticisms of HQ’s renewability. To me, it is particularly disturbing that our state’s Climate Action Plan foregrounds equity and environmental justice considerations, and yet the same Plan implicitly endorses environmental attributes that all our neighbors have rejected in part because of environmental justice violations. The Climate Action Plan authors should have dug deeper.

The 8,760 Pound Elephant

Apart from concerns related to large hydro, REC accounting has another flaw that hasn’t received as much airtime. The flaw is that RECs are resolved annually rather than hourly, and the result is the over-statement of the renewability of our electric supply.

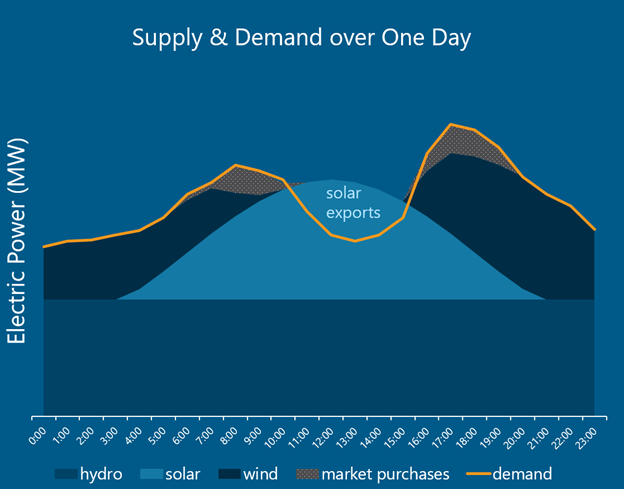

Utilities are only required to turn in an amount of RECs that they’ve accumulated over the course of the year, regardless of when or where those RECs were generated (due to un-bundling). A Vermont utility might have contracted for a lot more solar generation than it needed on a sunny afternoon, so it might then sell that excess power, but keep the RECs. Later, when the sun isn’t shining and the wind might be still, the utility will need to buy fossil fuel power off the grid. Under our current annually-resolved REC accounting system, those fossil energy purchases are invisible because they have been canceled-out by the accumulated solar RECs from earlier in the day.

Carbon Free? Current legislation allows utilities to use renewable exports (keeping unbundled RECs) to mask the carbon impacts of wholesale power purchases. Annually resolved REC accounting makes this possible.

You could argue that the utility deserves credit for incrementally cleaning up the grid by selling the unbundled “residual” solar generation back to the grid in the afternoon. Indeed, someone else must be buying that excess energy even if the utility is not using it, which constitutes one fewer MWh from a gas turbine. Theoretically this makes sense to me. But the theory turns out to be overly simplistic. The grid is a super complex physical and economic system, and fortunately, researchers have taken the deep dives here to answer just this question: how much does annually resolved REC accounting overstate the grid’s renewability?

Sally Benson and Jacques de Chalendar (of Stanford University’s School of Sustainability and Department of Energy Science and Engineering, respectively) published a paper in 2019 called “Why 100% renewable energy is not enough.” One of their conclusions: “Annual methods could overstate emissions-reductions by 50% in a policy-compliant 2025 scenario, when solar energy reaches 25% of the annual mix.”

Let’s dig into this conclusion. Emissions reductions have been overstated by 50%. If Vermont utilities call themselves 100% carbon free, and our baseline grid is 52% fossil-fuel based, and the reduction is overstated by half, then we’re actually still 26% fossil-fuel based in this scenario. There’s a world of a difference between 0% and 26%.

We can get a second opinion here (although not surprisingly it also comes from California). Peninsula Clean Energy (PCE) is a community choice aggregator, meaning multiple communities have banded together to purchase their own power which the utility then delivers to them over the wires. PCE understood the annual accounting problem and wanted to quantify the carbon emissions of their power purchases on an annual basis. They commissioned the open-source MATCH model, which can be used to find lowest-carbon power purchasing options using either annually or hourly resolved carbon accounting. When PCE ran this model on their own energy supply, they found the carbon intensity of their electricity jumped from 5 lbs CO2e/MWh using annual accounting to 223 lbs CO2e/MWh using hourly, an increase of 40x. (This is actually pretty similar to applying Benson and de Chalendar’s conclusion above to Vermont’s case, as it represents a drop from >95% carbon-free to ~75% carbon-free, assuming natural gas is the great majority fossil fuel generator).

But the problem here is more than just the numbers. And this is what really gets me. State-endorsed annual REC accounting methods effectively block the grid’s real-time carbon signals from reaching a commercial building owner. “We’ve got this,” the utility says. “Our electricity is already carbon free, don’t worry about it, just electrify your building.”

While I broadly endorse electrification as a solution to climate change, I know there are also big implications to time-of-use. In this era of energy transition, the carbon intensity of the grid is always changing, depending on how much sun is shining, how much wind is blowing, how much AC is running in the neighborhood, if it’s a cold snap, or if we’re undergoing a grid peaking event. Consequently, carbon intensity of one MWh of electricity on the ISO New England wholesale market ranges from about 200 to 1,200 lbs CO2e, depending on the hour. While these numbers on the grid are always fluctuating, state legislation allows utilities to absolve themselves of any relationship to those carbon emissions through unbundled REC trading.

Unless we embrace hourly accounting frameworks – either through legislative change or through the voluntary adoption of tools like the MATCH model – we are dodging the problem of renewable supply intermittency. On the demand side, we are undervaluing demand-response and flexible load programs. We are dragging our feet rather than letting loose our technical problem-solvers on the biggest obstacle right now in the energy transition. Benson and de Chalendar put it well: only when carbon metrics shift to using hourly data will they “convey accurate control signals to induce both appropriate investments in low-carbon generation assets and load-following behavior.”

What might these investments be? Paying EV owners to use their cars as grid batteries? Piping carbon intensity values directly to DDC controllers and allowing machine learning to optimize HVAC for low-carbon operation? These sound like tall orders, but they might sound more achievable in a world where time-of-use was accurately valued. Unfortunately, we don’t know what demand side solutions we’re missing because the signal is blocked by annual accounting at the utility level. It’s great that some utilities sponsor load management programs, but the valuation of load curtailment is based on value to the utility alone; what impact does a peaker plant shutdown have on a building owner’s carbon footprint? None, because that electricity was already carbon-free… right?

Let’s say I want to enroll in a utility program that only charges my EV during off-peak hours. Many Vermonters are fortunate to be served by utilities that offer rebates for this. What if I wanted to quantify the reduction to my building’s carbon footprint? Again – if the utility is messaging that my electricity is already carbon free, then it follows that my smart charger does nothing for decarbonization.

As I guide building owners and asset managers through decarbonization using the GHG Protocol, I’m required to calculate both the “market-based” and “location-based” emissions of the buildings and operations. For most of our clients, “market-based” will reflect a utility’s REC purchases, and “location-based” will be ISONE grid averages, which presently constitute about 50% natural gas. Until hourly accounting is adopted by state renewable energy standards, this discrepancy will persist. This is unfortunate because it gives very mixed signals to organizations seeking to decarbonize, with very real effects that shape markets for commercial HVAC equipment and controls. Should I install a hybrid heat pump/gas furnace or a heat pump with a backup electric resistance coil? The answer, unfortunately, depends on which number you use.

Vermont has long considered itself to be a leader in the energy transition. In reforming the RES, we have the opportunity not only to join our New England peers in aiming for a renewable portfolio target that is both more ambitious and more equitable, but also to become a leader among them by rejecting unbundled RECs and adopting an hourly accounting standard for our utilities.

Further Reading

To find out more about hourly carbon accounting, check out initiatives towards 24/7 CFE. Here are some additional resources:

- EnergyTag.org. 24/7 carbon tracking non-profit rethinking the REC. They are pushing for a “GC” (granular certificate) which includes a time-of-generation attribute.

- Volts Podcast episode: discussion with Jan Pepper of PCE (source of my information above). Thanks to Jake Marin for sharing this with me.

- Why 100% renewable energy is not enough (Joule 2019). Referenced above.

- WattCarbon. 24/7 CFE marketplace for voluntary carbon offsets using hourly accounting. See also founder McGee Young’s substack articles.

- Renewable Energy Vermont. A clean energy trade association advocating for reform to Vermont’s Renewable Energy Standard.

- Vermont Department of Public Service has a number of webinars explaining the RES.

- Outside In podcast episodes about Hydro Quebec.