Cx Associates is a mission driven energy engineering firm that works with buildings, mostly Commercial and Industrial buildings, and one of our central missions is to be part of the solution to climate change. Professionals in our field understand the challenge we’re facing. The Biden Administration National Climate Task Force has set the goal of a 100% net-zero emission economy by 2050. To meet this goal, we need to decarbonize the grid, but renewables account for just 13% of electricity generation in the U.S. While that’s close to a tripling of levels a decade ago, we still have a long way to go.

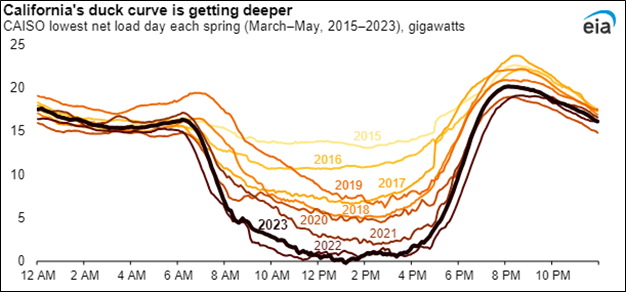

The market for renewables looks better almost every year, and adding more renewable generation to the grid is a necessary part of the solution. However, relying solely on supply side solutions will only get us so far. You might be familiar with the “Duck Curve”, which originated in a study done by the National Renewable Energy Laboratory (NREL) in 2008 that examined how to plan for large-scale integration of solar electricity generation on the grid. One of the messages of the duck curve is that adding more solar, while super important, becomes less effective at avoiding fossil fuels over time. This is because the sun doesn’t shine 24 hours a day, and fossil fuel-based generators are already idle (i.e., not needed) at the time of day the solar panels will produce power. Fossil fuel grid energy kicks in between 7PM and 6AM, no matter how many solar panels you have, and the challenge becomes how to flatten out the duck curve to provide 24/7 carbon-free energy.

Source: U.S. Energy Information Administration

Source: U.S. Energy Information Administration

Buildings Can Help. A lot.

Until dispatchable (i.e., we can produce energy from it anytime we want, as much as we want) energy sources other than nuclear become available, we should look to demand side solutions, and the largest player on the demand side of the grid is by far buildings. Buildings consume 75% of electricity generation (and even more at peak) and account for 40% of annual global CO2 emissions. Studies show that including demand side solutions could offer the cheapest pathway to decarbonization. A recent study[1] by the Lawrence Berkeley National Laboratory and the Brattle Group demonstrated that high performance buildings can substantially ease the transition to a carbon-free grid. The study found that massive investment in building efficiency and demand flexibility could achieve deep emissions reductions by 2050 (up to nearly half of reductions) and reduce the cost of decarbonizing the grid by more than one third. Put another way, efficient, grid-responsive buildings would make a zero-carbon grid $100B cheaper per year.

What does a building as a grid asset look like? A prototype of a building that would support grid management is found in the Grid-interactive Efficient Building, or GEB. GEB is about enabling buildings to provide flexibility in energy use and grid operation, or grid services. Key features of GEBS include:

- Energy efficiency. This includes a well-insulated enclosure as well as efficient equipment. And while we’re upgrading equipment, we should choose electricity-powered equipment, like heat pumps and electric water heaters.

- Sensors and controls to monitor and manage energy usage, occupancy patterns, and environmental conditions. Examples are smart-thermostat-controlled air conditioners, grid-responsive appliances and EV chargers, occupancy sensors, and daylight sensors. Data from all this equipment should be stored and analyzed for patterns so that corrections in operation can be made.

- Two-way connectivity with the grid so that 1) the controls self-adjust energy usage in response to real-time grid conditions, such as reducing consumption during peak demand periods or using stored energy when electricity prices are high, 2) data is provided to grid operators and utilities to help them manage the grid, allowing utilities to execute response protocols and improve forecasting.

- Distributed energy and energy storage. Solar panels, wind turbines, and heat pumps not only produce energy for the building, but also have the potential to sell back to the grid. Energy storage means that energy is available when the sun isn’t shining and the wind isn’t blowing.

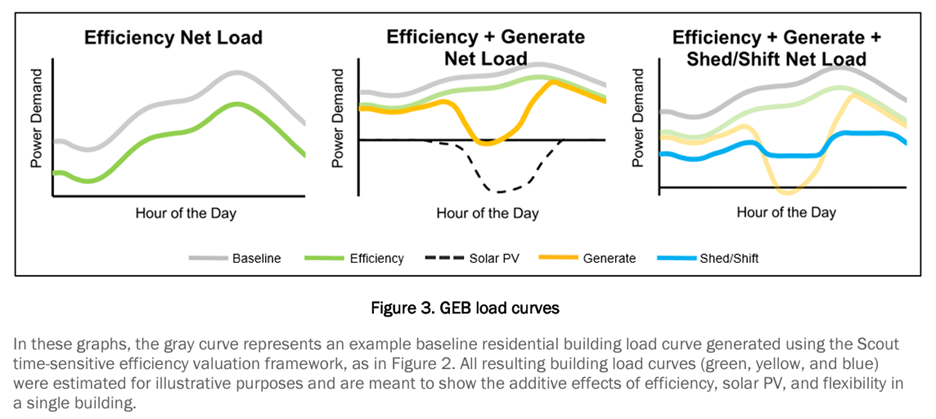

Here’s a visual representation of what a Grid-interactive Efficient Building can do for the duck curve problem[2]. The green line is made possible by energy efficiency and should always be the first step. The yellow line represents distributed renewable energy and establishes the duck curve. The keystone is the blue line, and is accomplished through load shedding, load shifting, and storage. These three-grid services amount to a network of grid assets that can respond to signals about the carbon content of the energy flowing through the grid with reduced/shifted demand and on-site consumption of stored energy. Examples of load shifting run from pre-cooling a space prior to occupancy, charging an EV during off peak hours, or using a timer to run your dishwasher at noon while you’re at work to time of use process structures and demand response incentives.

Overcoming Barriers.

If using demand-side solutions to decarbonize the grid is cheaper and more effective than solely relying on supply side, how do we get there? I’m going to address two barriers here.

Barrier 1: Cost

In our business, we hear a lot of interest in decarbonization from building owners, but transforming a building into a grid asset is pretty costly. It’s important that building owners are empowered through good supply side programs that target the technology and behavior we need. In fact, studies show that it’s more cost effective to invest in building owners than to ask them to bear the cost themselves.

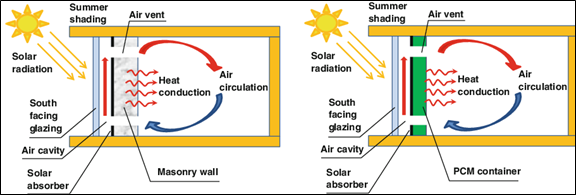

Building enclosures are a good example. Enclosures remain central to energy efficiency and decarbonization. One study[3] found that deep enclosure retrofits to a multifamily flat extended occupant comfort during periods of no power to days rather than hours, which could get New England through a peaker event. Another study[4] demonstrated how passive thermal storage needs active thermal storage, which involves technology along with orienting your house along a north/south axis, to meet long-term demand response. All well and good, but how do we pay for the retrofits? One cost/benefit study[5] found that, while the ROI for thermal storage is not favorable for building owners, it is for utilities if you include peak demand management and deferred capital for peaking power plants in the equation, and as long as there is large market penetration. This demonstrates that we need bold public policy and investment to get the most out of what buildings have to offer.

Image source: Kośny, J. (2015). Short History of PCM Applications in Building Envelopes. In: PCM-Enhanced Building Components. Engineering Materials and Processes. Springer, Cham. https://doi.org/10.1007/978-3-319-14286-9_2

It also demonstrates the importance of including true cost when weighing the cost effectiveness of program development. Our decarbonization service involves a lot of the same stuff as energy efficiency, but it changes how the benefits of efficiency are quantified and prioritized. If you want to capture climate benefits, you need to identify the externalities, or the hidden costs of not taking action. Recently there was a story in the New York Times that Green Mountain Power is giving away batteries to its customers because the remediation costs from the recent extreme weather events in Vermont makes it cheaper to do that than building more power lines. Extreme weather is an externality that’s not monetized in the price of fossil fuels, and certainly not in the price of natural gas, which accounts for about 40% of electricity production in the US. Research[6] has shown that switching from propane or oil to heat pumps will save the consumer energy and money. The same can’t be said of natural gas because the current price of natural gas doesn’t include the true cost of GHG emissions.

Barrier 2: Annual Carbon Accounting

It’s important to recognize that a load shift action at the building level only has value in the context of the carbon intensity of the electricity running through the grid at any given time, and electricity has different carbon intensity depending on the time of day (expressed as lbs. or tons CO2e/MWh). Harken back to the duck curve where 7PM to 6AM feature a much more carbo intense mix of electricity sources. However, from a building owner’s perspective, your “share” of carbon is determined by the average carbon intensity of the grid times how much energy you use in a year. This is your building’s carbon footprint.

Further, and without getting too far into defining them, we rely on Renewable Energy Credits (RECs) as an accounting tool to quantify the amount of renewable energy we use. Once “used” to offset a certain amount of carbon-based electricity generation, RECs are retired, and that retirement happens annually. A utility can buy enough RECs to essentially hide the periods of the day where they rely on fossil fuel-based electricity to meet demand. Recent research has found that annual accounting understates the carbon intensity of the grid a lot, and that it is valid only when fluctuations in renewable generation are small. One study[7] found that that emissions-reductions could be overstated by 50% by 2025, when solar energy reaches 25% of the annual mix. In another case study[8], a community choice aggregator called Peninsula Clean Energy commissioned the MATCH model to find lowest-carbon power purchasing options using either annually or hourly carbon accounting. When PCE ran this model on their own energy supply, they found the carbon intensity of their electricity jumped from 5 to 223 lbs. CO2e/MWh by switching from annual to hourly, an increase of 40x.

Beyond the research, it makes sense that a message of “you’re covered because your electricity is already carbon-free” does not incentivize building owners to enroll in demand management programs or buy a more efficient electric chiller, even those who want to do their part to address climate change.

Another issue with annual accounting is that it doesn’t give us the granularity to fully value demand-side solutions like flexible load programs, because time-of-use signals related to carbon are being absorbed. Yes, there are time-of-use rates, but those are based on power prices to the utility. For those of us looking to do carbon accounting for our buildings, carbon-intensity-based time of use signaling is masked by REC trading. On the other hand, if hourly carbon intensity data were available to building owners through a user interface, a program to charge the EV during off-peak hours would make more sense, and might just engage me, the building owner, in owning my building’s carbon footprint more. And what other kinds of grid services can we promulgate through building owner engagement? Things like paying EV owners to use their cars as grid batteries, or feed carbon intensity values into DDC controllers and allowing machine learning to operate HVAC for low-carbon? We don’t know what demand side solutions we’re missing until we connect hourly carbon accounting with the demand side.

Notice these examples are actions taken by building owners based on carbon intensity signaling, not actions taken by utilities based on peak signaling, which is still important, but not the full picture. If we’re serious about fully decarbonizing the grid and achieving our national climate goals, we need available hourly accounting and more robust programs to realize the potential of demand side grid management. As de Chalendar put it: only when carbon metrics shift to using hourly data will they “convey accurate control signals to induce both appropriate investments in low-carbon generation assets and load-following behavior.

[1] Langevin, J., et. al. 2023. Demand-side solutions in the US building sector could achieve deep emissions reductions and avoid over $100 billion in power sector costs. One Earth. Volume 6, Issue 8, 1005-1031.

[2] Neukomann, M., et.al. U.S. Grid-interactive Efficient Buildings Technical Report Series. Department of Energy Office of Energy Efficiency & Renewable Energy. Dec 2019.

[3] Erba, S. and Barbieri, A. (2022) Retrofitting Buildings into Thermal Batteries for Demand-Side Flexibility and Thermal Safety during Power Outages in Winter. Energies 15(12):4405.

[4] Chen, Y.; Xu, P.; Chen, Z.; Wang, H.; Sha, H.; Ji, Y.; Zhang, Y.; Dou, Q.; Wang, S. Experimental investigation of demand response potential of buildings: Combined passive thermal mass and active storage. Appl. Energy 2020, 280, 115956.

[5] Li, Zhenning, et. al. (2021) Cost Targets to Achieve Commercially Viable Thermal Storage in Buildings. Oak Ridge National Laboratory for the U.S. DOE.

[6] Goldenberg, C., M. Dyson, and H. Masters. 2018. Demand Flexibility: The Key to Enabling a Low-Cost, Low-Carbon Grid. Basalt, CO: RMI. rmi.org/wpcontent/uploads/2018/02/Insight_Brief_Demand_Flexibility_2018.pdf.

[7] Chalendar, J.A., Benson, S.M. Why 100% Renewable Energy Is Not Enough. Joule. Volume 3, Issue 6, 1389-1393. June 2019.

[8] Pepper, J., Miller, G., Maatta, S., Shahriari, M. Achieving 24/7 Renewable Energy by 2025. Peninsula Clean Energy white paper. January 2023.