One of the most challenging parts of my job is when despite identifying cost-effective energy saving opportunities that have additional benefits, such as equipment lifetime extension and reduced maintenance costs, a company decides not to follow through with the project. Whatever the cost or the payback period, sometimes companies remain reticent to make a capital investment in even the simplest and most inexpensive improvements during volatile economic times. So, I herald the concept of “green banks” and revolving loan funds that states and utilities are implementing as another tool to make it easier for businesses to make smart investments in energy efficiency measures.

Energy Efficiency is a Safe Investment

Commercial buildings (office, retail, lodging, educational and health-care buildings) account for 19% of the energy consumed in the United States and more than half of this energy is required to heat and light these buildings [1]. Efficient technologies such as variable speed drives for motors, occupancy sensors for lighting control, efficient light fixtures, and HVAC control systems are tried-and-true technologies that have proven their cost-effectiveness beyond a shadow of a doubt. In a time of insecurity in the financial markets today, investments in many energy efficiency measures are secure and, dare I say, guaranteed winners.

Photo by epSos.de

Photo by epSos.deWhy The Financial Help is Necessary

The issue for many commercial spaces such as office and retail is that utility bills are often paid by tenants, whereas equipment improvements are the responsibility of the building owner. The building owner does not have an incentive to reduce energy costs other than tenant retention and maintenance cost reduction. Therefore even low hanging fruit such as lighting replacement and lighting control improvements, which typically provide payback in less than one year, are difficult to convince an owner to invest in. The public sector of the commercial market, such as schools and municipal buildings, often doesn’t have the capital available for improvements. Efficiency utilities, states and some financial institutions are realizing these investment barriers and are responding with creative methods to overcome these hurdles.

Green Banks and Revolving Loan Funds

In January 2013 Governor Andrew Cuomo announced the formation of New York’s new $1 billion green bank, in his State of the State address. Earlier this month, the Ohio Council of Smaller Enterprises, efficiency-services financer Metrus Energy, and CalCEF announced the new Ohio Efficiency Resource Fund, and California has spearheaded innovative financing policies such as Property Assessed Clean Energy (PACE) bonds, on-bill repayment, and credit enhancement for small and medium-sized businesses. In Vermont, a dozen colleges and the University of Vermont have partnered with Efficiency Vermont and Burlington Electric Department in establishing green revolving funds in response to the fall of 2011 announcement of the Sustainable Endowments Institute’s “Billion Dollar Green Challenge.” The Burlington Electric Department in Burlington, Vermont has also received a $1 million Economic Development Administration grant in 2012 to help “up to 150 commercial electric users during its first round of capitalization to help them make electrical upgrades to achieve greater energy-efficiency” [2].

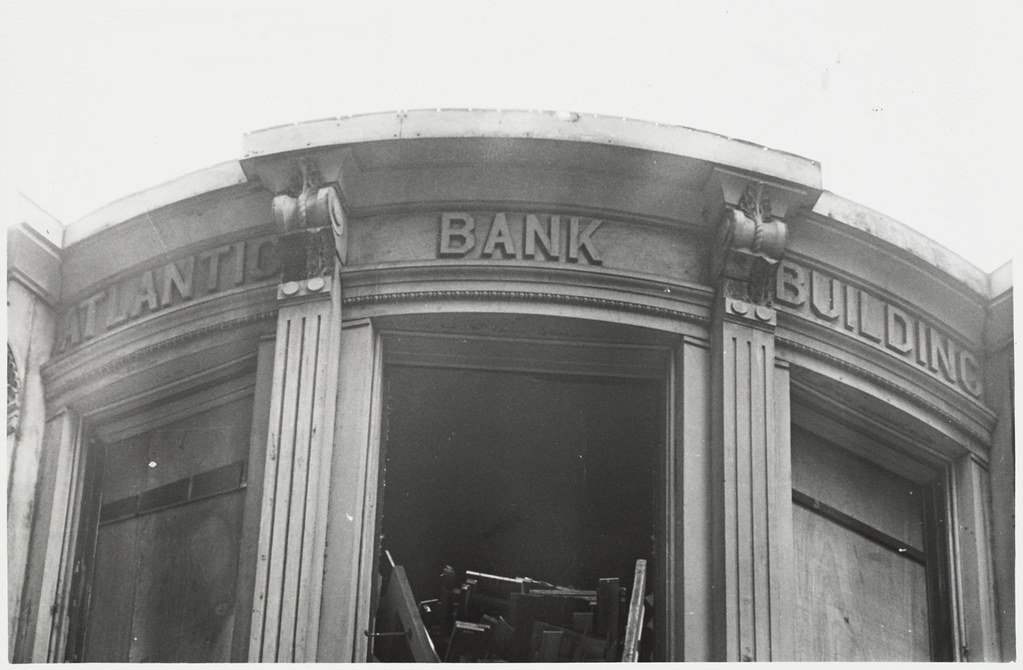

Photo courtesy Boston Public Library

Photo courtesy Boston Public LibraryGreen banks are also coming into existence. “A green bank is a finance bank set up by the state that uses limited public dollars and leverages private capital to provide a combination of low-interest rate funding (making clean energy projects competitive) and low-cost 100 percent up-front loans for energy efficiency projects” [3]. I believe this financial model has a great chance of success because it provides an opportunity for commercial financial institutions to become comfortable with the safe return on investments that energy efficiency projects provide.

The Role of the Energy Efficiency Engineer

Unfortunately, building owners often do not trust energy saving claims. This is where we all have our work cut out for us. The facts support the claims, but changing long established attitudes is always an uphill battle. Luckily, the financial markets are paying attention to the proven cost-effectiveness of energy efficiency improvements and we energy advocates have more resources to convince building owners. Persistence will hopefully bring success! A lot is at stake for our country and a lot can be gained for our economy.

-----------------------

References:

[1] http://aceee.org/portal/commercial

[2] http://www.eda.gov/news/pressreleases/2012/10/01/burlington_vt.htm

[3] http://www.coalitionforgreencapital.com/whats-a-green-bank.html